Pay Spread; Tweaking Comp Models; Succession Planning

Pay Spread

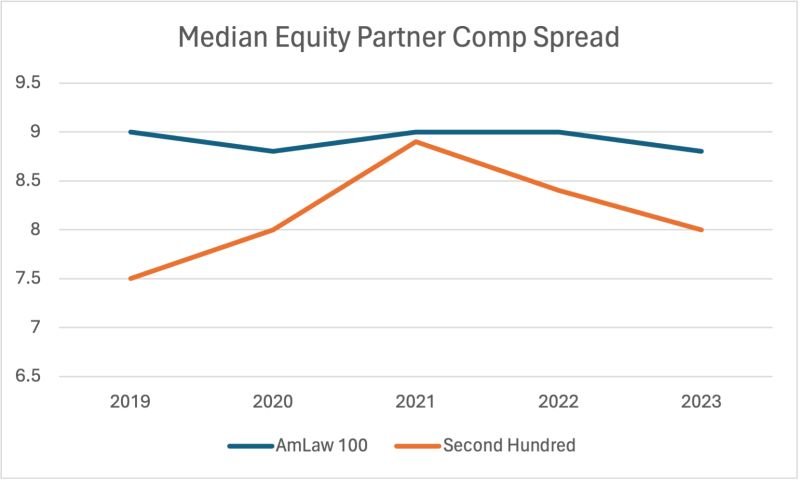

The American Lawyer reported last month that the "Am Law 100 upped its average equity partner pay spread from 9.8-to-1 in 2022 to 10.3-to-1 in 2023" (Largest Law Firms Increase Partner Pay Spread, as Comp Models Hit 'Inflection Point', Andrew Maloney, 5/28/24). In my experience, median equity partner pay spread figures are more instructive than averages. Averages among the AmLaw 100 and Second Hundred have been skewed by outliers like Fisher Broyles which reported a 1,010: 1 spread for fiscal year 2020, pushing the average for the Second Hundred that year to 25.1:1, despite the fact that all but one of the other reported spreads were below that 25.1:1 average.

Examining median pay spreads over the last five years, one finds no consistent trend in either the AmLaw 100 or the Second Hundred.

That may change going forward starting with fiscal year 2024, as anecdotes and rumors of firms increasing spreads may cause a significant number of firms to adjust their spreads as well.

Tweaking Comp Models

A recent report by legal consultancy Fairfax reveals that firms are changing compensation models both to attract lateral partners and to retain younger high-performing partners who are "increasingly impatient with the slow up/slow down approach inherent in many partner compensation systems" (Evolving Approaches to Partner Compensation, Lisa Smith et al, May 2024, Fairfax Insights). More firms are adding levels to the top end of their compensation system, but this can lock firms into higher compensation outlays when those partners have a down year. To ameliorate, some firms are awarding "super points" in lieu of adding levels; others are maintaining existing levels, but moving partners up and down more quickly both to reward, and make room for, higher performers.

Firms are also increasing their bonus pools. Larger bonus pools can increase the spread among partners in two ways: 1) directing payments to high-performing partners; and 2) reducing the value of points, by diverting $ to the bonus pool that would otherwise have been distributed. Fairfax noted that bonus pools have increased to 10-12% of net income, up from 5-8%, with some bonus pools as large as 25%.

Succession Planning

The American Lawyer recently hosted a webinar focused on succession planning (How to Tackle the Biggest Challenge for Law Firms: Succession Planning, 4/25/24, Law.com Pro Webinar Series). The panel offered several process-oriented suggestions at the firm level:

Institutionalize the planning process, i.e. whenever any partner reaches a pre-determined age, meet with that partner about succession planning and then meet every year thereafter. Years of preparation can ease the transition. And a uniform process can remove any insinuation that a particular partner may be declining or have one foot out of the door.

Make the impetus for succession planning not about age but books of business, under the "hit by a bus" principle.

Utilize annual meetings to understand a particular partner's goals and drivers (firm legacy; personal legacy; control; money; concern over client service; fear of retirement).

At the individual partner level, panelist David Wood notes that partners must train and mentor their successor, must disclose to clients the timetable of succession, and "must gradually step back and train clients to request services from the successor partners alone, while providing successors with constant, task-by- task coaching from behind the scenes" (Retirement Planning Can Hedge Against Lateral Partner Acquisition Risks, David Wood, 4/15/24, Law.com).

But how do firms incentivize partners to do this? Wood noted that his firm protected his compensation during the period in which he was not showing up on the bill but was still active behind the scenes sharing institutional knowledge and offering guidance. He argues that double-paying in this way can be cheaper than losing clients due to poor planning and/or trying to back-fill through lateral hiring. Paul Weiss Chair Brad Karp voiced a similar approach at a recent panel hosted by the International Bar Association in Miami:

We will give credit to senior partners who hand over client relationships to younger partners and basically treat them as if whatever collections, originations, revenues were attributable to the client for a number of years—they get full credit for it. So there’s no economic incentive to clasp client relationships and not let go (Paul Weiss Chair Brad Karp Weighs in on How to Poach-Proof Your Firm, Amy Guthrie, 5/16/24, Law.com International).

Panelists at the Law.com Pro webinar suggested implementing an "anti-hoarding" rule, through which partners must articulate what they have done to ensure that younger partners are beginning to receive calls from their clients. Another panelist suggested that firms spread capital repayment over a four or five year period so that retiring partners have an interest in the longer-term financial health of the firm and do their part to ensure that their clients stay after they leave.

But with any of these measures, firms must be cognizant of potential lawsuits over age discrimination or other claims, like those alleged by Michael Kline former equity partner and Corporate Department Chair at Fox Rothschild ('Hang Up Your Spurs': Longtime Fox Rothschild Partner Claims Age Discrimination in NJ Lawsuit, Amanda O'Brien, 5/30/24, National Law Journal, suing in part over firm policy that mandates transferring billing responsibility at the age of 72).